What is Wealth Management?

Wealth Management

Wealth Management is the organized investment and growth of money over time. Occasionally, individuals perform their own Wealth Management. But, more often, a Registered Investment Advisor (RIA) firm performs it for individuals. Consequently, these firms make money by charging fees for various services they provide to these individuals. Typically, firms sell managed account services. To clarify, these are discretionary investment accounts that are traded by a firm investment manager on behalf of an individual. A well-known example of an RIA firm is Charles Schwab.

When earmarked for retirement, the goal of Wealth Management is to invest retirement Savings and maximize Earnings. The further away from retirement, the higher the acceptable investment risk. A guideline for determining acceptable risk is the Rule of 100. To summarize, it says individuals should hold a percentage of higher risk investments (stocks, mutual funds, etc.) equal to 100 minus their age.

What is Retirement Income Management?

Retirement Income Management vs.

Wealth Management

Retirement Income Management is the second phase of any Wealth Management savings earmarked for retirement. This second phase should begin about 10 to 12 years before the planned age of retirement. It involves the transition of retirement savings into safer investments in preparation for a dependable source of regular retirement income.

Fixed Index Annuity

Safer Investment

As an example of safer investments, retirement savings could be transitioned into a Fixed Index Annuity (FIA). To clarify, an FIA is a deferred annuity that allows the premium (principal) to grow for many years before annuitization. During this growth period, the premium amount earns interest based on the performance of chosen market indexes (like the S&P 500). These interest earnings are capped to never go negative (a $0 floor), even during severely downturned markets.

The FIA protection against market loss protects the start of retirement from any delay due to a downturned market. With Wealth Management investments that have no floor protection, a delay may be necessary. This is because income withdrawal(s) taken during a downturned market solidifies investment loss. Too many losses at the beginning of retirement may severely reduce the amount of future available retirement funds. So, utilizing an FIA in Retirement Income Management can help ensure retirement begins when planned!

Guaranteed Income for Life

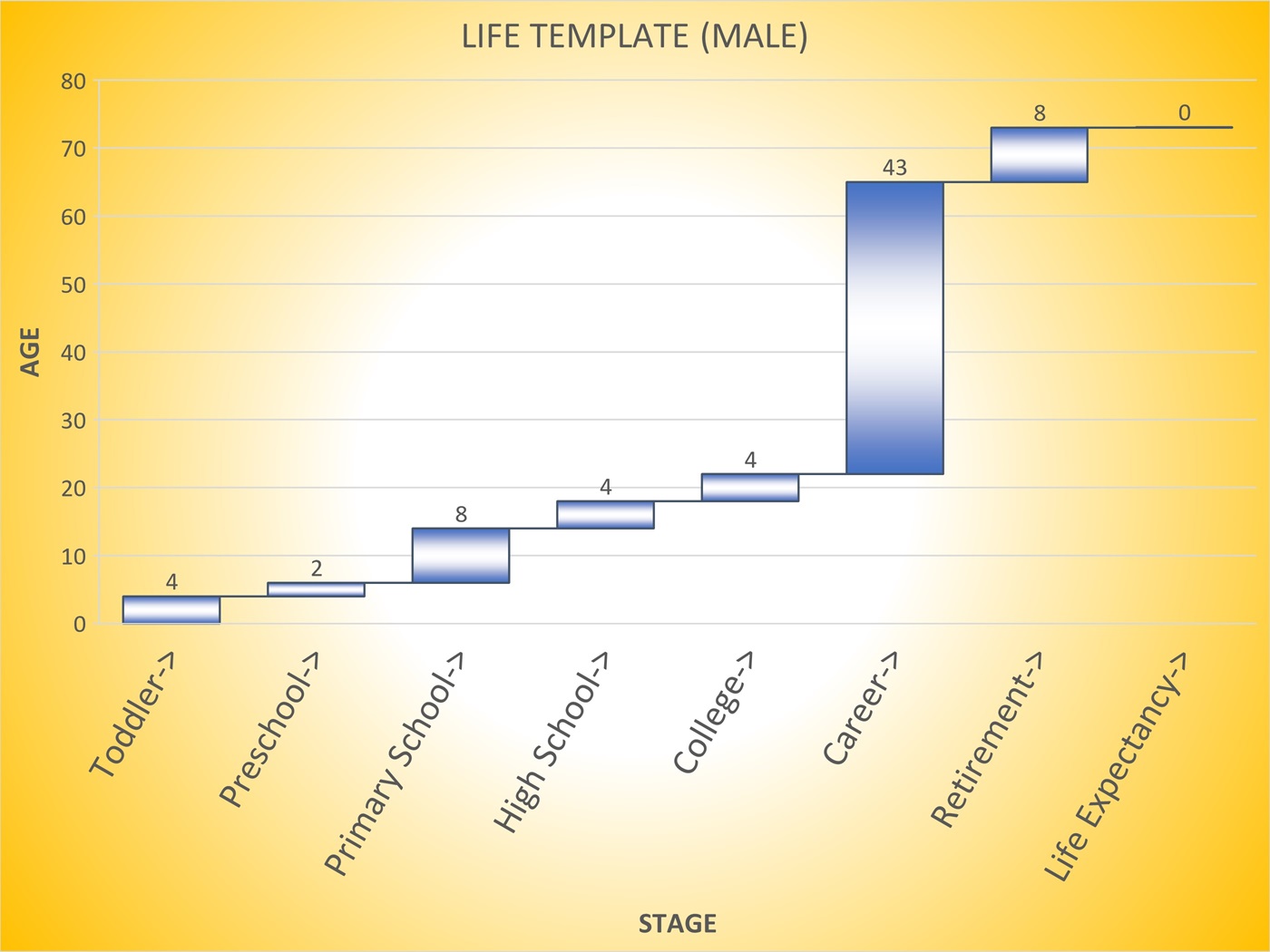

Unlike other stages of life that have a defined beginning and end, the retirement stage has only a defined beginning. The end of the retirement stage is dependent upon the occurrence of death. Death can occur at any age. Consider the generic "Life Template" shown above. Assume retirement begins at the age of 65 (the U.S. average retirement age for a male). Then, assume death occurs at the age of 73 (the U.S. average life expectancy for a male). Correspondingly, the average retirement stage duration is 8 years. However, death could also occur at the age of 100. Correspondingly, the retirement stage duration could be 35 years. How can a retiree plan necessary income for a retirement that could last from an average of 8 years to potentially 35 years?

As discussed, an FIA used in Retirement Income Management provides peace of mind that retirement can begin when planned. Likewise, an FIA used in Retirement Income Management provides peace of mind that retirement can end whenever, regardless of how long that might be. The reason for this is that an FIA is a binding contract between a retiree and an insurance company. In exchange for a sum of money provided by the retiree, the insurance company guarantees the retiree regular income payments for life. Consequently, it is the insurance company that takes the risk for a life that lasts longer than expected. The retiree does not have to worry about it!

Other Advantages

During the growth period (the period prior to annuitization), an FIA has some additional features. Firstly, the FIA provides a death benefit, whereby an elected beneficiary can receive the proceeds from the FIA. This protects the retiree should he or she die before annuitizing. Secondly, the FIA allows limited withdrawals to provide income payments without the need for annuitization. Lastly, in some cases, the FIA offers financial incentives to continue in the growth period and forego annuitization altogether. This is a Lifetime Income provision.

Alternate Approach

There is an alternate approach to Retirement Income Management that transitions only a portion of retirement savings into safer investments in preparation for retirement income. The remaining portion continues to participate in higher risk investments by means of Wealth Management. The actual amount transitioned into safer investments for Retirement Income Management depends upon a number of individual factors. However, the amount should be sufficient to provide at least the minimal income a retiree would need to live on, when combined with other income sources not provided by Wealth Management. In some situations, this amount may include all of the retirement savings. Consequently, this alternate Retirement Income Management approach may not be possible for some retirees.

Hedge Protection

Implementing the above alternate approach provides a retirement Hedge (financial safeguard) for continued participation in the Wealth Management higher risk investments (with higher potential returns). In each retirement year, a retiree decides whether to take income payments from Retirement Income Management funds or Wealth Management funds (or a combination of both). During a year of a downturned market, all or most of the income payments should be taken from Retirement Income Management funds. During a year of an upturned market, all or most of the income payments should be taken from Wealth Management funds. The reason for this annual decision is that taking income payments from Wealth Management funds during a downturned market solidifies a market loss, and should be avoided.

Indexed Universal Life

In our previous example, Retirement Income Management used the FIA to provide Hedge protection. In this case, the income payments taken from Retirement Income Management funds would be FIA withdrawals. However, Retirement Income Management could also use a special type of life insurance called Indexed Universal Life (IUL) instead of, or in addition to, the FIA. When an IUL is used, the income payments taken from Retirement Income Management funds would be IUL loans against an accumulated policy cash value. These loans can be taken during retirement and never paid back (the total amount associated with the loans is deducted from the life insurance death benefit upon the death of the retiree).

Whether by FIA and/or IUL, providing Hedge protection for continued higher risk Wealth Management investments during retirement allows for a combination of the best of both investment worlds. Determining which Hedge protection to use (FIA, IUL, or both) depends upon a number of individual factors. However, in certain situations, the IRS allows a retiree to take essentially Tax-free* income payments from an IUL (of both premium payments and interest earnings) using the policy loan provision! Consequently, for this reason, the IUL has an advantage over the FIA (and practically all other retirement investments).

* Check with your tax advisor to confirm applicability of this tax advantage to your specific situation.

Navigate Uncertainty to Get Ready... Get SET!

We can help you navigate the uncertainty of the market to create a safe retirement plan. Won't you give us a call?