Medical Plan Information You Should Know

The different "Parts" of Medicare are a reference to the Medicare statutes of law. Accordingly, one can find these statutes under Title XVIII of the Social Security Act. To clarify, this Title is split by topic into several parts:

Part A - Hospital Insurance Benefits. This also includes coverage for skilled nursing facilities, rehabilitation facilities, and hospice.

Part B - Supplementary Medical Insurance Benefits. This includes a broad range of outpatient services such as physician care.

Part C - Medicare Advantage. These plans must cover Part A and Part B benefits. However, they could also cover additional benefits.

Part D - Prescription Drug Coverage. This is standalone coverage (the plans in Part C may also include prescription drugs).

Part E - Miscellaneous Provisions. These include Medicare Supplement (also referred to as "Medigap") and Medicare cost plans.

Medical Plan Information You Need to Know!

The initial eligibility period to sign up for Medicare starts three months before the month you turn 65. Then, it ends three months after the month you turn 65. Furthermore, there are penalties for failing to sign up during this seven-month period.

PART A

If you must pay a premium for Part A and you don't get Part A when you're first eligible for Medicare, your monthly premium may increase 10% for each full 12-month period you could have had Part A, but didn't sign up. Moreover, you'll have to pay the higher premium for twice the number of years you didn't sign up. However, if you currently have group health coverage through a company with 20 or more employees, you may be able to delay getting Part A and not pay a penalty if you enroll later. (Note you must pay a Part A premium if you have had less than 40 quarters of work contributions to Medicare taxes.)

PART B

If you don't get Part B when you're first eligible, your monthly premium may increase 10% for each full 12-month period you could have had Part B, but didn't sign up. Most importantly, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B. However, if you currently have group health coverage through a company with 20 or more employees, you may be able to delay getting Part B and not pay a penalty if you enroll later.

PART D

If you don't get Part D when you're first eligible and you don't have other creditable prescription drug coverage (coverage that meets minimum standards set by the Center for Medicare and Medicaid Services), your monthly premium may increase by 1% of the current "national base beneficiary premium" times the number of months you didn't have Part D or creditable coverage. Most importantly, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part D.

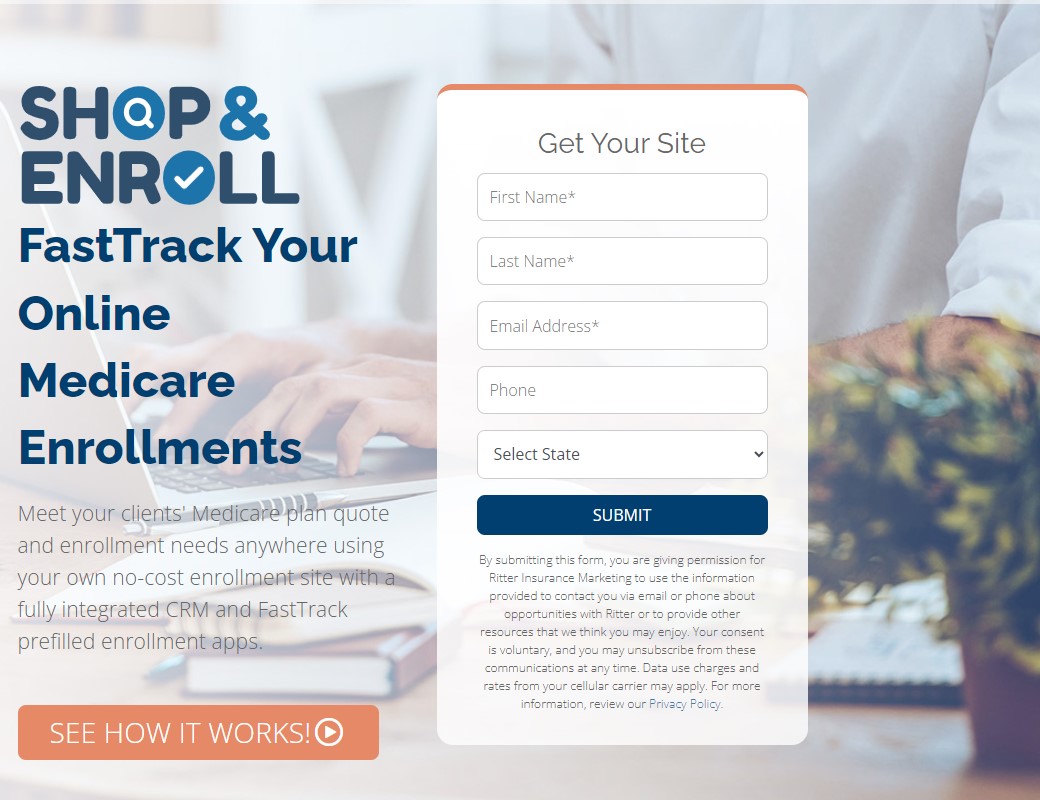

Shop & Enroll

The marketing and selling of Medicare plans is regulated by the Centers for Medicare & Medicaid Services (CMS) and your state's Department of Insurance. At SET, we strive to make sure our clients make informed decisions. That's why we offer "Shop & Enroll". Shop & Enroll is a powerful tool to explain, explore, compare and even enroll in Medicare Advantage, Prescription Drug, or Medicare Supplement plans. With Shop & Enroll, you can feel safe knowing that you are using a Medicare platform that provides 100% regulatory compliance.

Medicare Help

Of course, we at SET would love for you to call us. We can tell you all about the many facets of Medicare. But, if you first wish to learn more about Medicare on your own, the United States government provides an official website that contains an abundance of very valuable information. Clicking on the link below will take you to this website. Subsequent to your visit to that website, make sure you return back to this website to utilize the Shop & Enroll tool (above). Or, feel free to give us a call to answer any questions. Because we are here to get you "SET" for your retirement.

Health Insurance Companies

In the southwest region of the United States that SET services, the following insurance companies are available (some variances may exist between the specific states of the region):

MEDICARE

(MA=Medicare Advantage, MS=Medicare Supplement, PDP=Prescription Drug Plan*)

Aetna (MA/MS)

Allwell (MA)

Americo (MS)

Anthem (MA/MS/PDP)

Assured Life Association (MS)

Bankers Fidelity (MS)

Bright Health Plan (MA)

Central States Indemnity (MS)

Cigna (MS)

Clover Health Plans (MA)

Guarantee Trust Life (MS)

Healthspring (MA)

Humana (MA/MS/PDP)

Lasso Healthcare (MA)

Lumico (MS)

Manhattan Life Insurance Company (MS)

Medico (MS)

Molina (MA)

Mutual of Omaha (MA/MS/PDP)

New Era (MS)

Oscar (MA)

Oxford Life Insurance Company (MS)

Sentinel Security (MS)

Thrivent Financial (MS)

Transamerica Premier Life Insurance Company (MS)

Union Security Insurance Company (MS)

UnitedHealthcare (MA/MS/PDP)

WellCare (MA/PDP)

Western United Life Assurance (MS)

DENTAL & VISION/HEARING

(D=Dental, V=Vision, H=Hearing)

Aetna (D/V/H)

Ameritas (D)

ManhattanLife Assurance Company of America (D/V/H)

Medico (D/V/H)

Mutual of Omaha (D)

New Era (D)

SureBridge (D/V/H)

EXTENDED CARE

(STC=Short Term Care, LTC=Long Term Care)

Aetna (STC)

Bankers Fidelity (STC)

Guarantee Trust Life (STC)

Kemper (STC/LTC)

Medico (STC)

Stay Healthy to Get Ready... Get SET!

We can help you choose the best retirement health care medical plan suited for your needs. Don't you think it's worth a call?